VAT EXEMPTION INFORMATION

All products on our website are eligible for VAT exemption so long as they are purchased for personal use or for use by a registered charity.

WHO IS ELIGIBLE?

The zero-rating of goods and services for a disabled person depends in part upon the status of the individual. In order to qualify for VAT Exemption, an eligible person must be 'chronically sick' or 'disabled'. Chronically sick means that you / they have an illness that is likely to last a long time e.g. arthritis, diabetes, angina, dementia, MS and stroke. Disabled means that you / they are substantially and permanently handicapped by illness or injury.

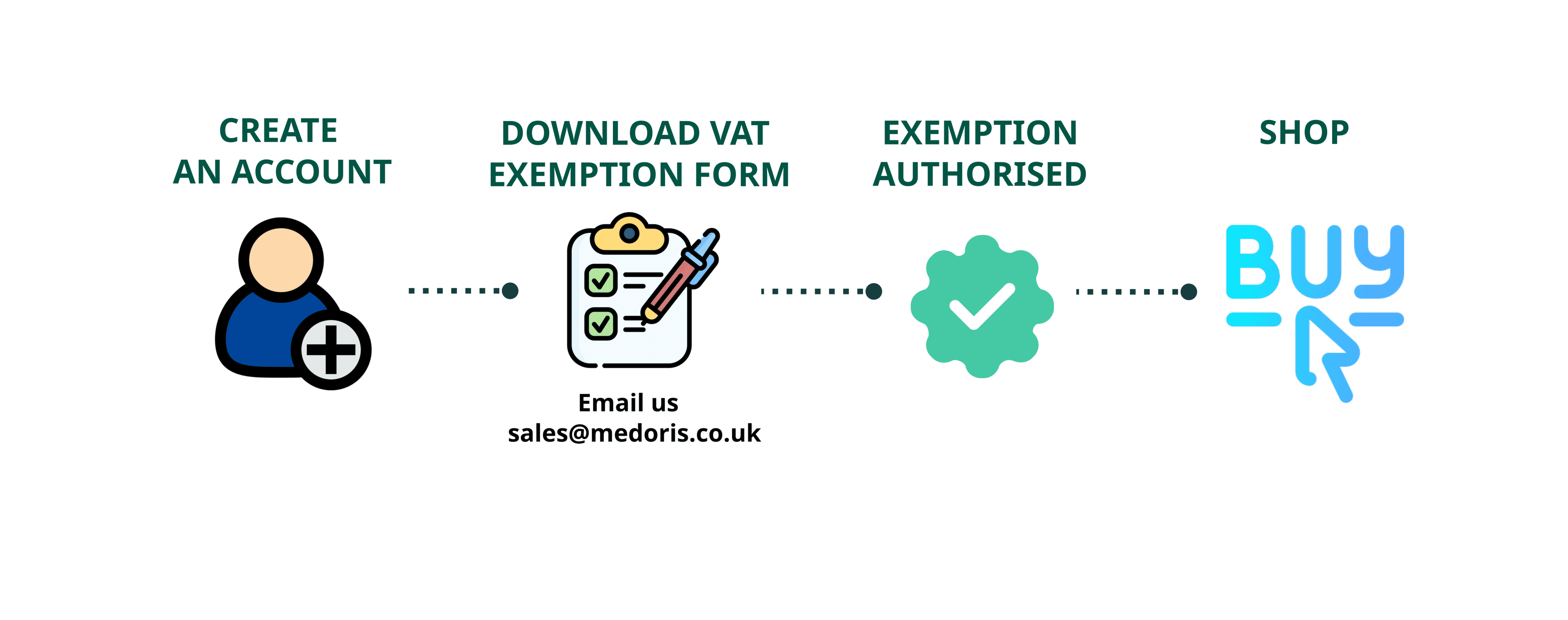

DOWNLOAD VAT EXEMPTION FORM

Please fill in your details and send the form to us at sales@medoris.co.uk, we will then enable your account as a VAT EXEMPT ACCOUNT ( once you have created an account ).

Charity VAT Exempt Option- If you are a charity purchasing products on behalf of an individual please select the Charity VAT Exempt option where in addition to being asked for the disability of the individual and the full name of the purchaser you will also be asked for the full name of the charity and the charity number.

Please note that you will still be charged VAT on the shipping element of you purchase.

If you have any doubts as to whether you qualify for VAT Exemption or require further information with regard to VAT Exemption please contact your local Customs office or call the National Advice Service on

0845302 02 03. Alternatively call us on 0333 207 9515 or email us sales@medoris.co.uk